30-DAY MONEY BACK

GUARANTEE FOR FEBRUARY ONLY!

30-DAY MONEY BACK GUARANTEE FOR FEBRUARY ONLY!

If 30 new dental patients do not flood into your practice calendar within the first 30 days of working with us you'll get a FULL REFUND with no questions asked...

If 30 new dental patients do not flood into your practice calendar within the first 30 days of working with us you'll get a FULL REFUND with no questions asked...

Two Comma Club X Award Winners

Year: 2023

2x Two Comma Club Award Winners

Year: 2021 & 2022

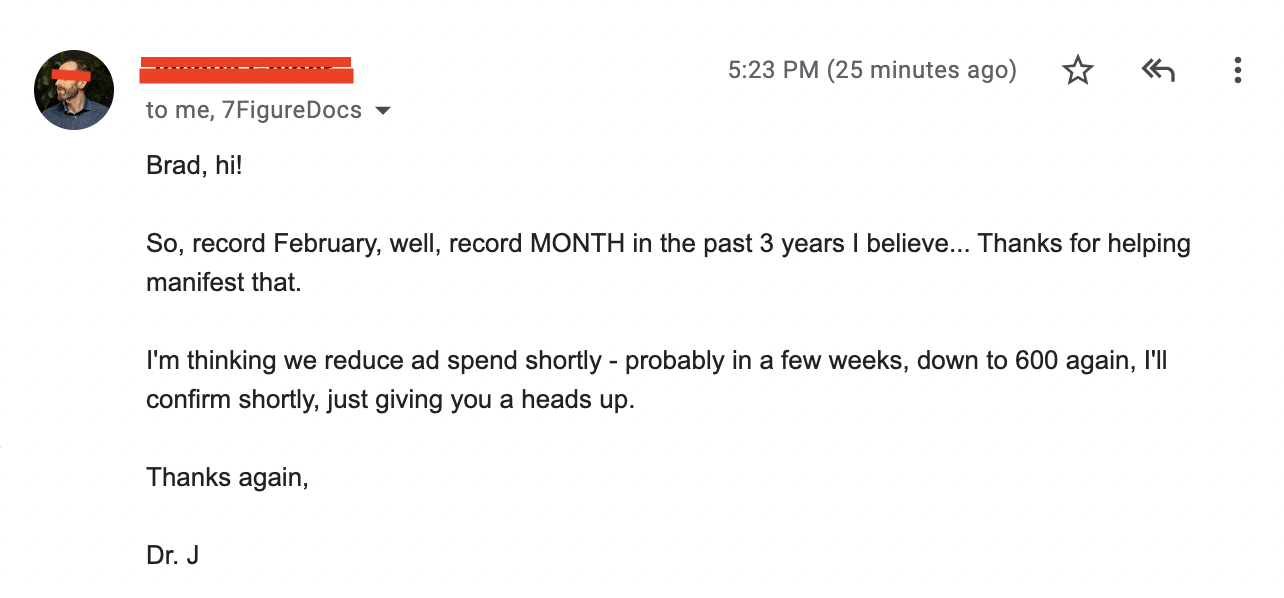

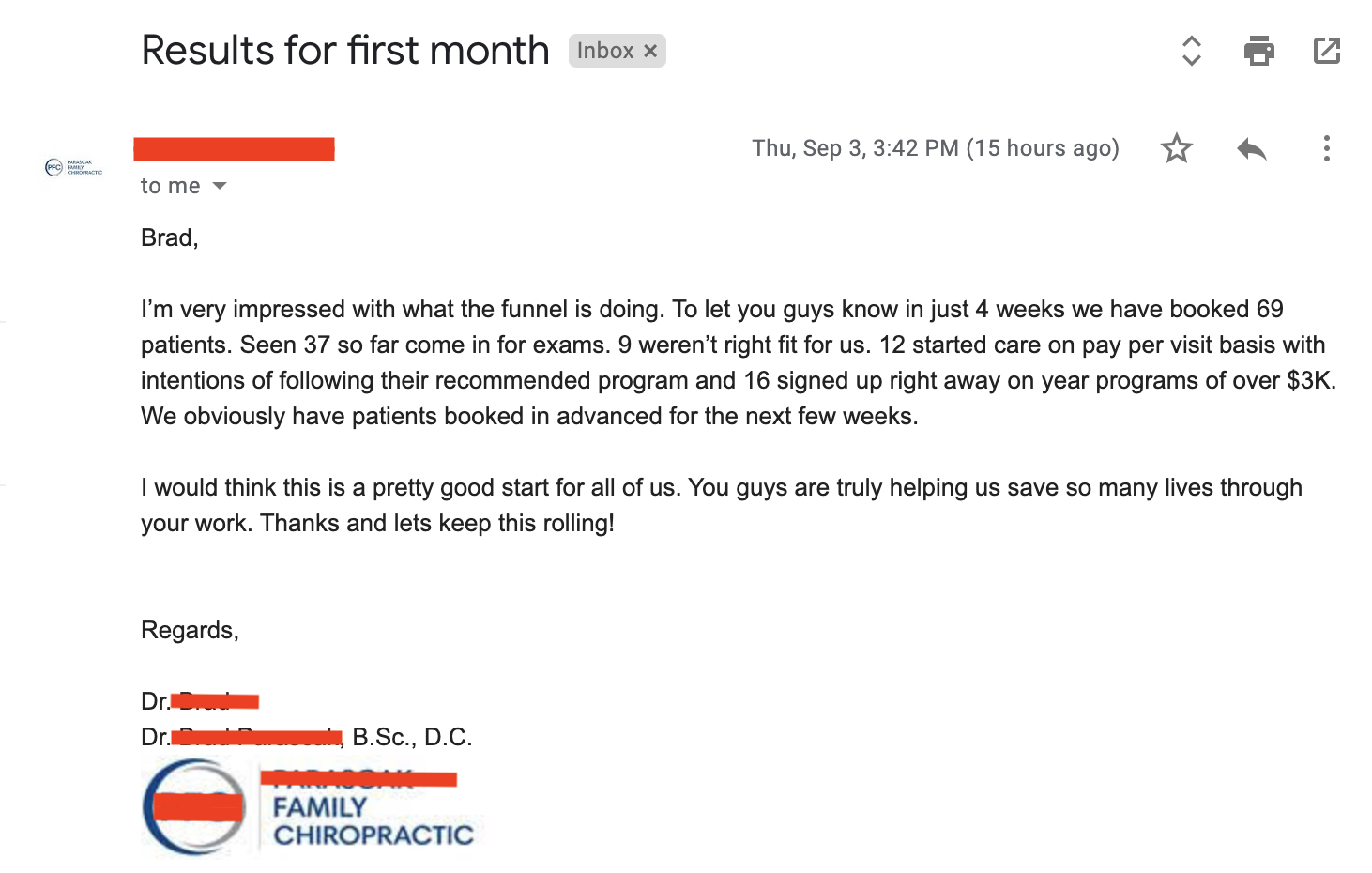

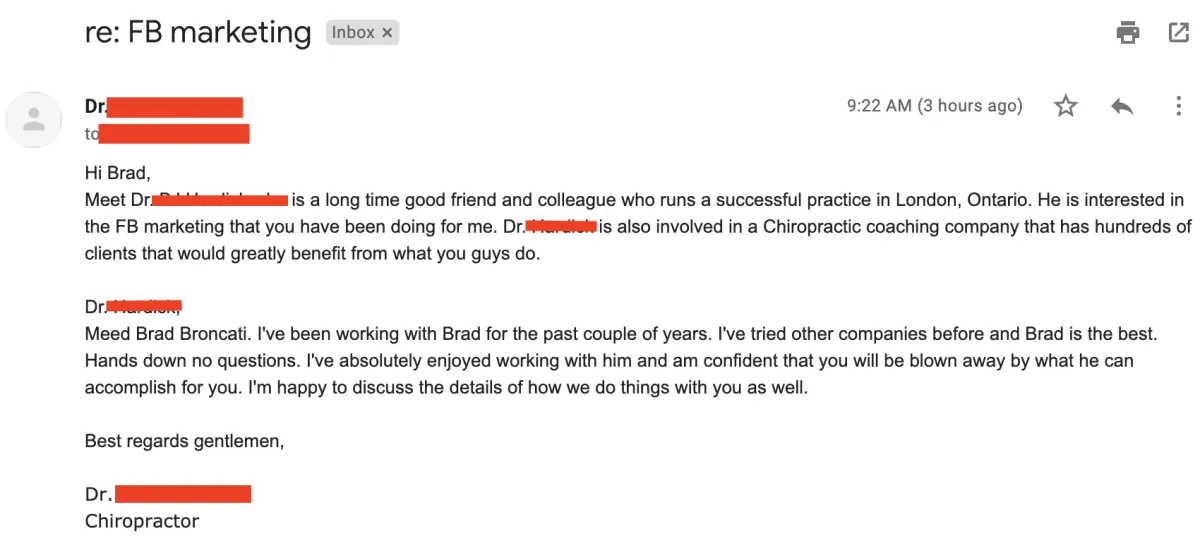

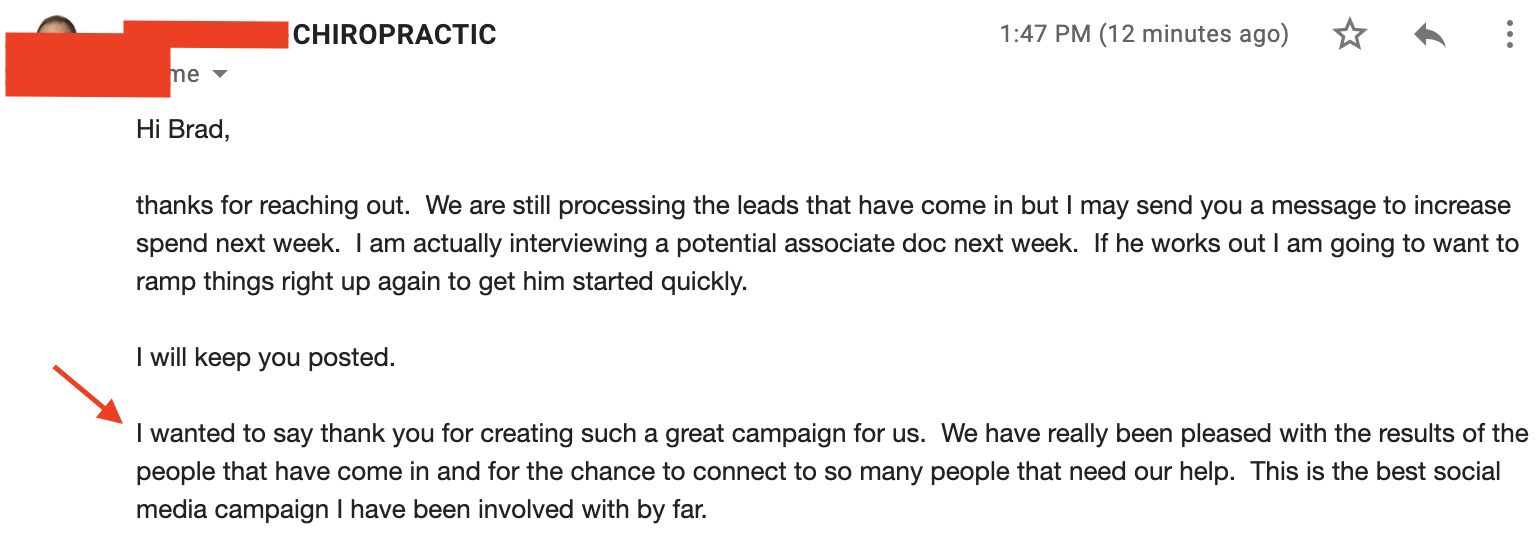

Jon Pevzner

Highland West Dental Care

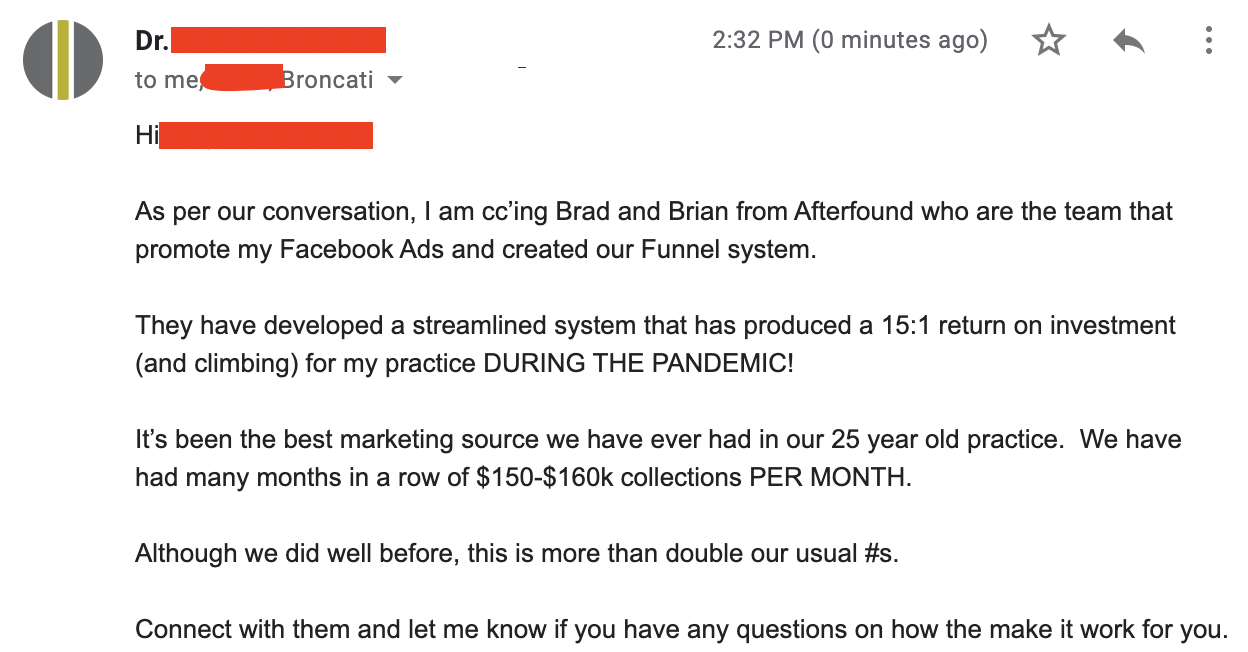

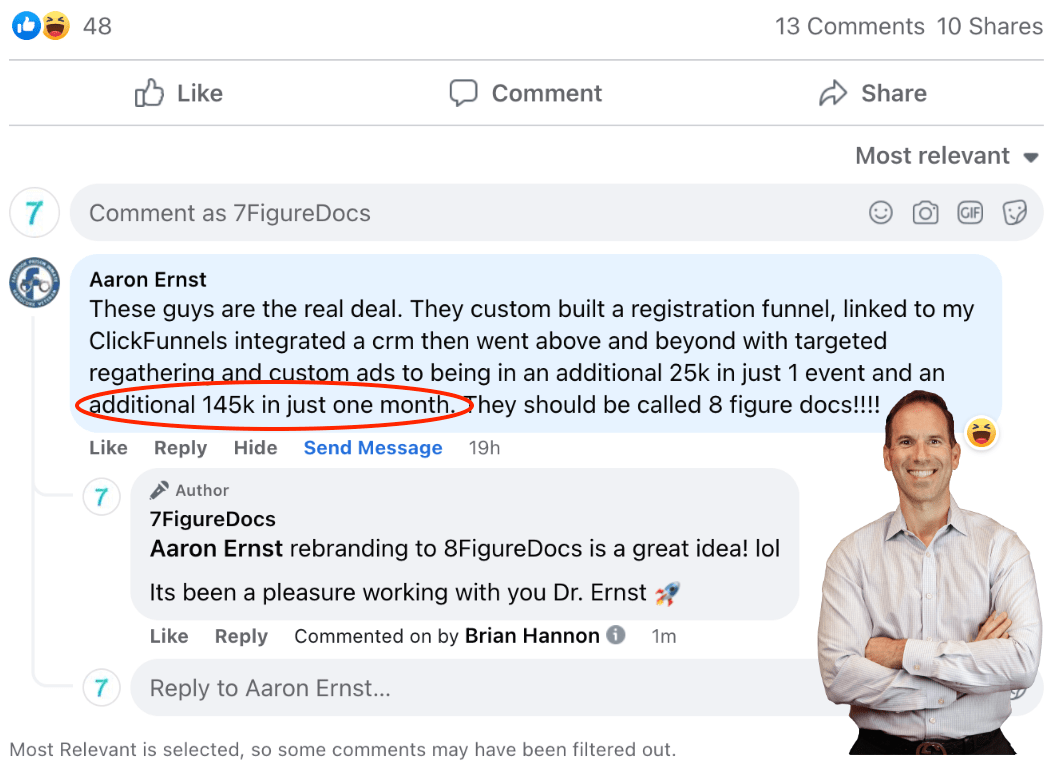

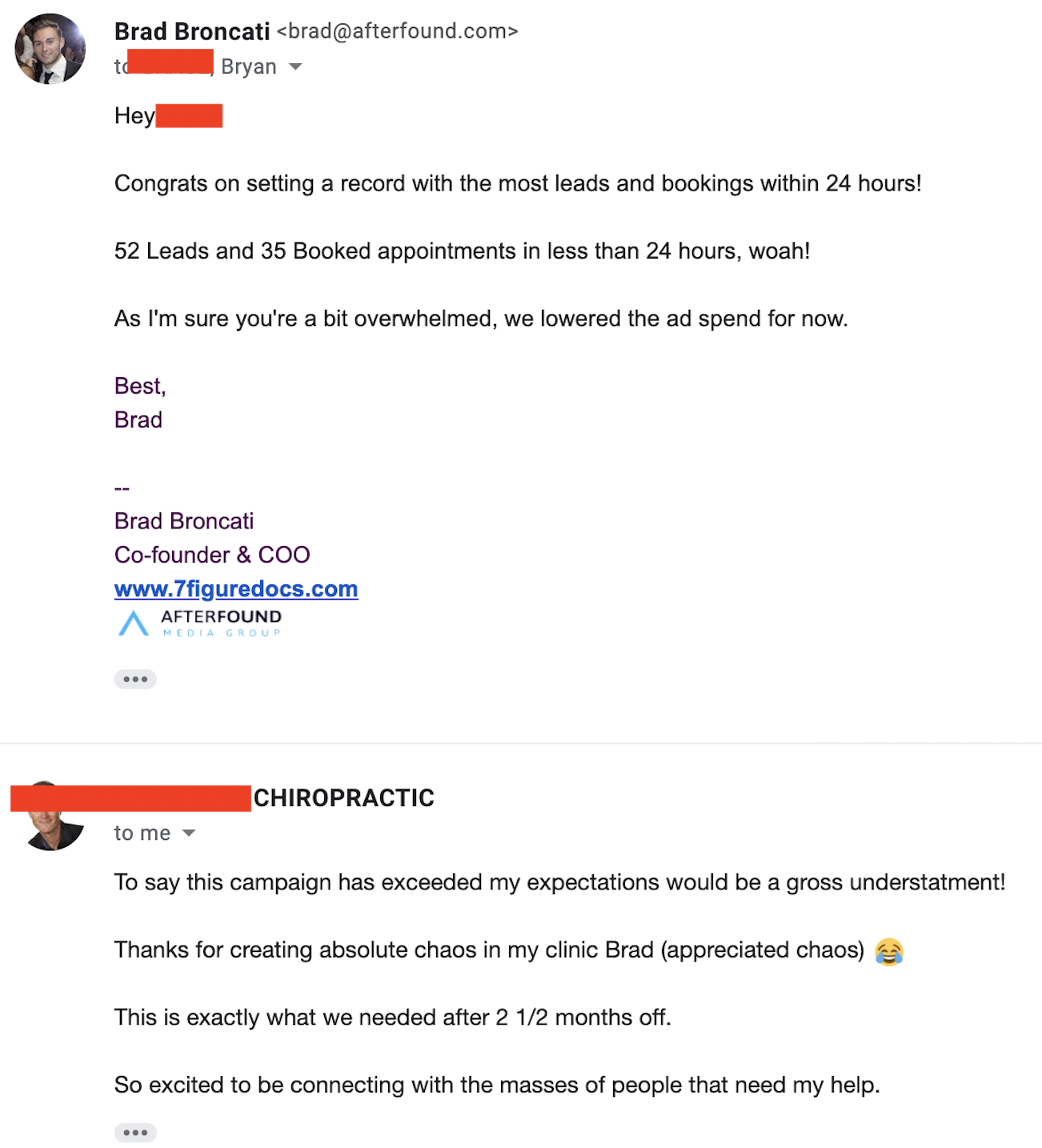

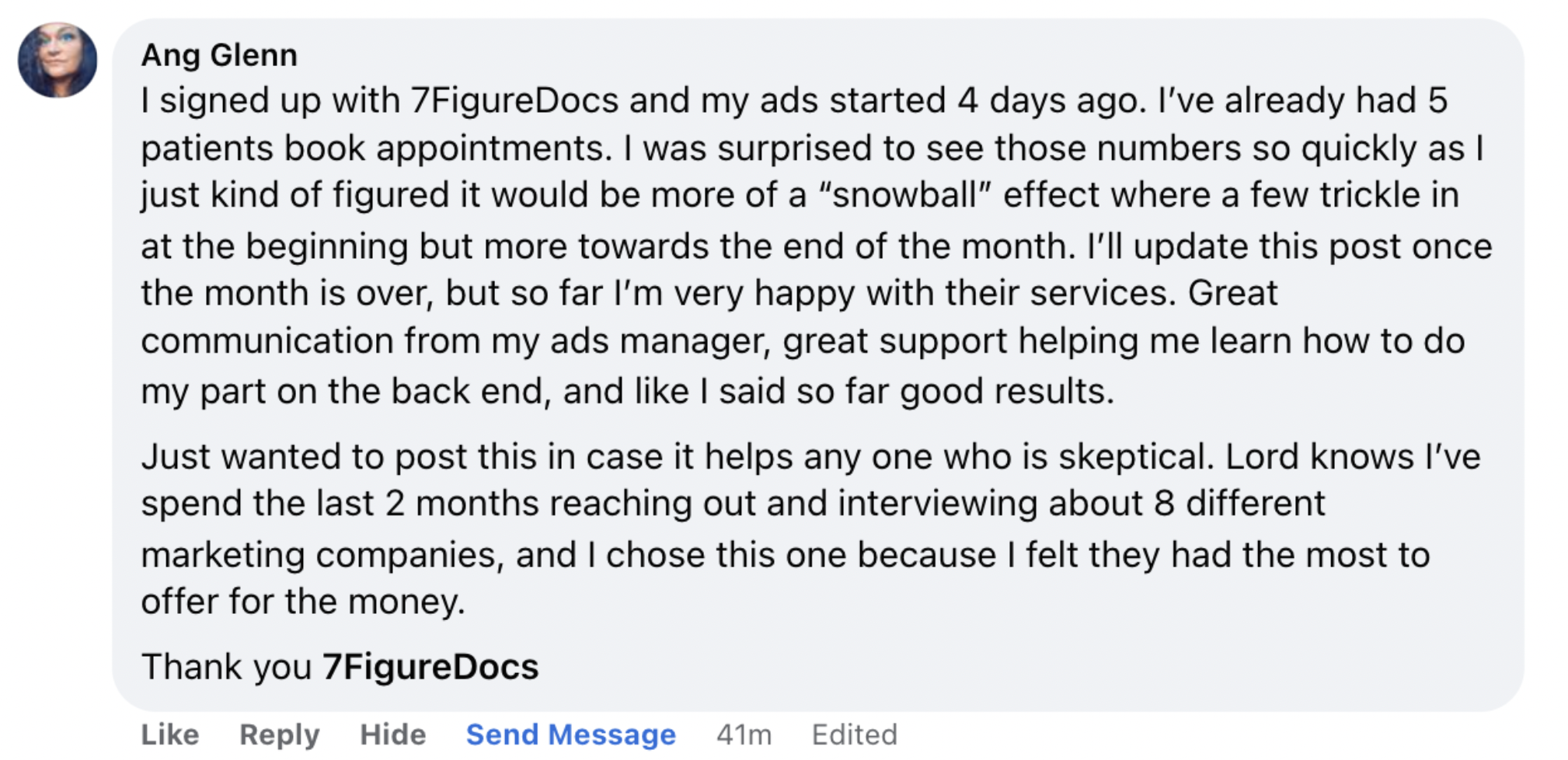

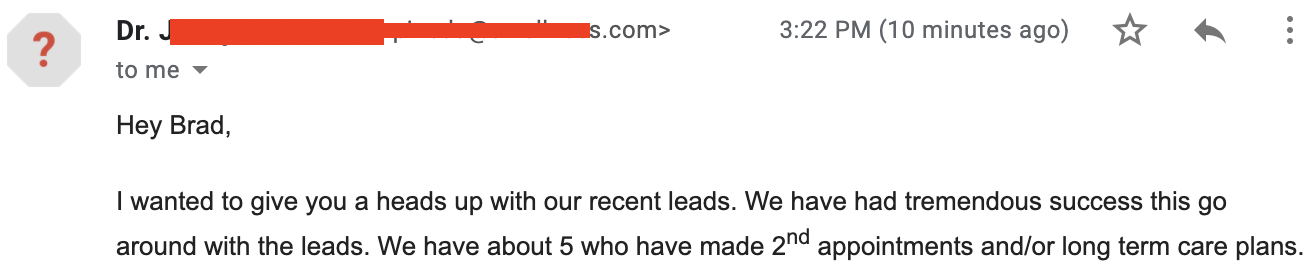

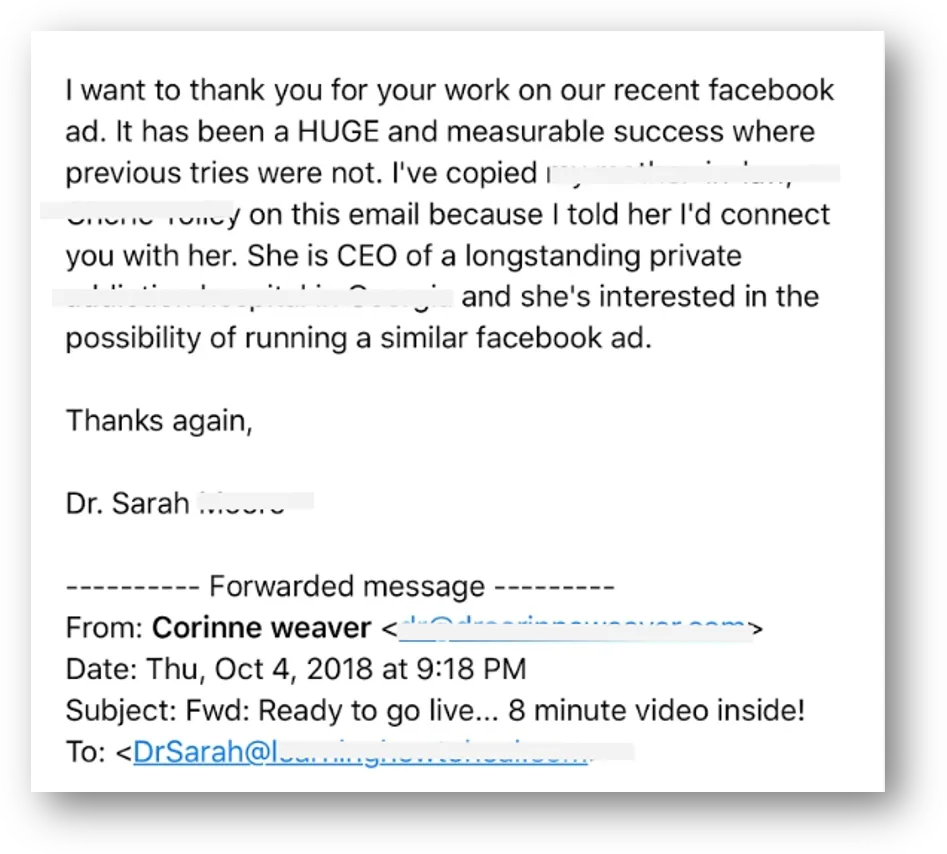

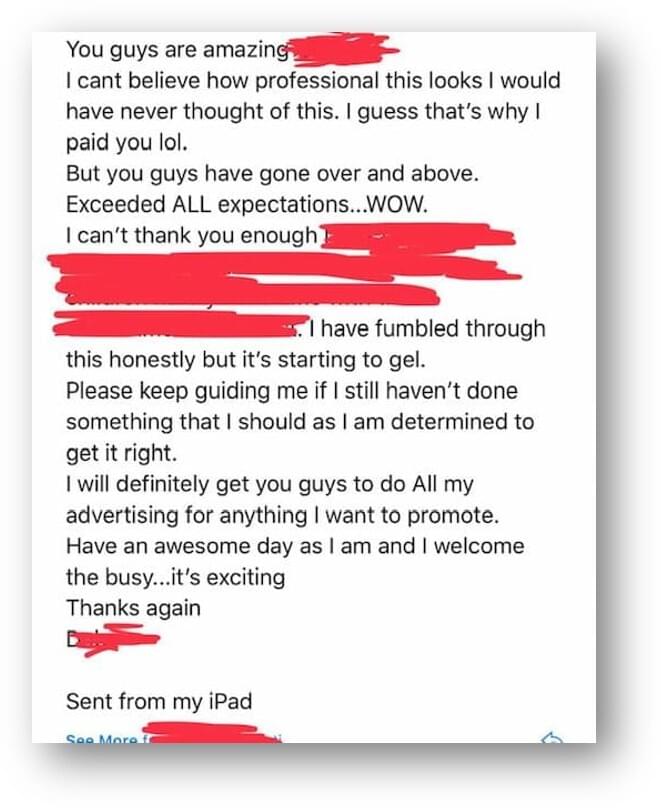

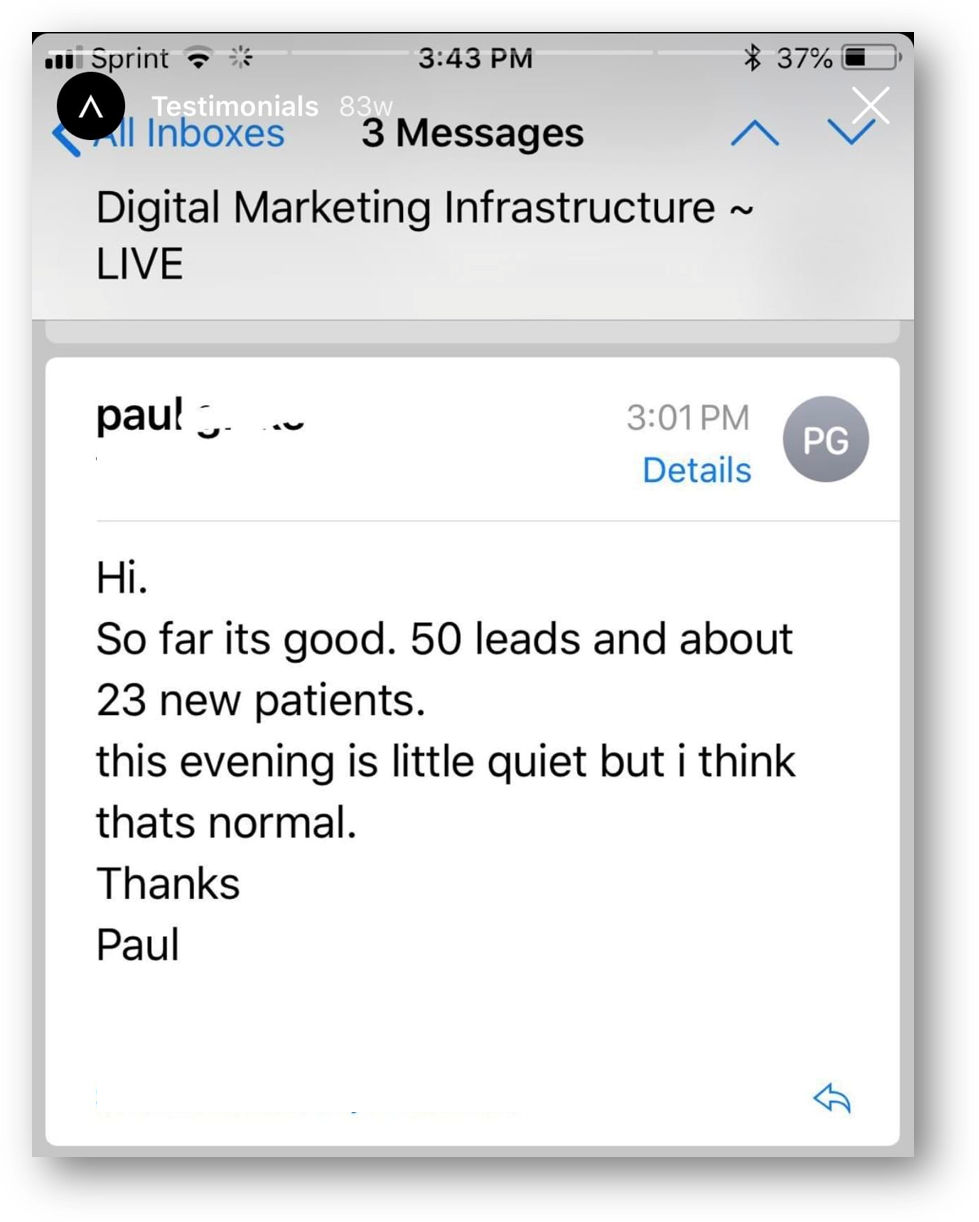

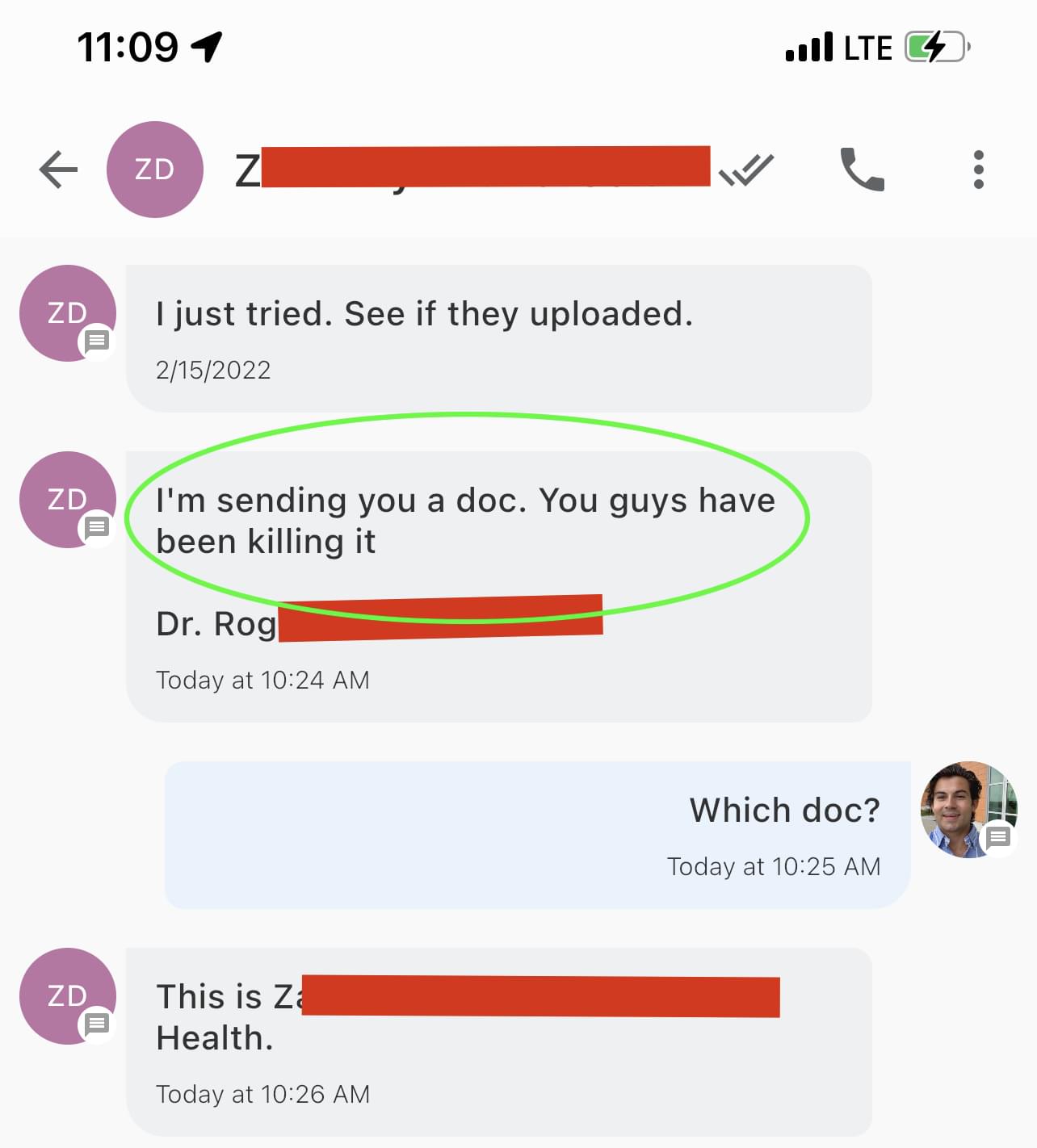

"New patients have been ringing our phones off the hook! It's the best marketing that I've done for the office thus far!"

Liviu Siteanu

Altitude Dental

"Our online visibility has skyrocketed and more importantly, we've seen a real increase in our conversion rates. It's not just about numbers, it's about real people choosing us for their dental needs."

Martin Zollinger

"Best 3 months in practice EVER!"

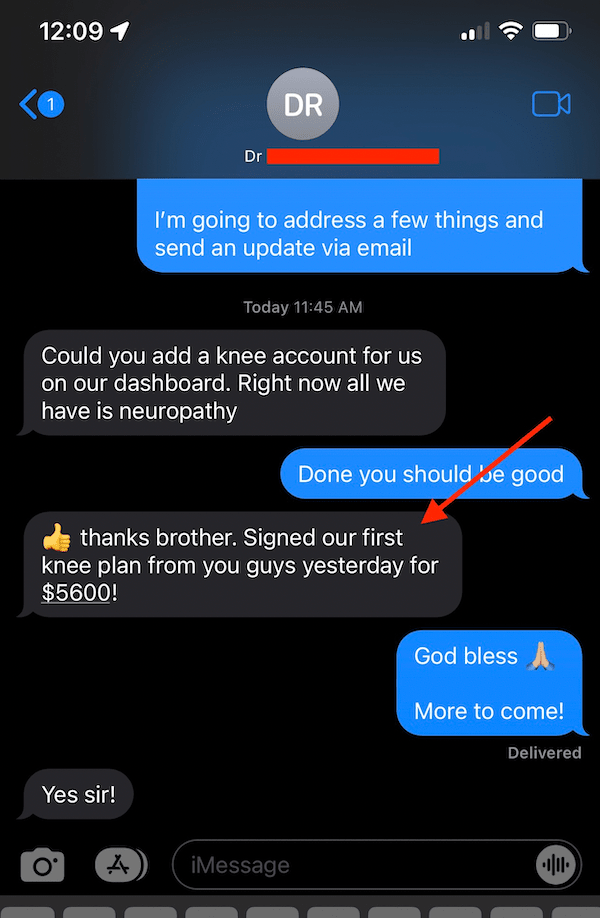

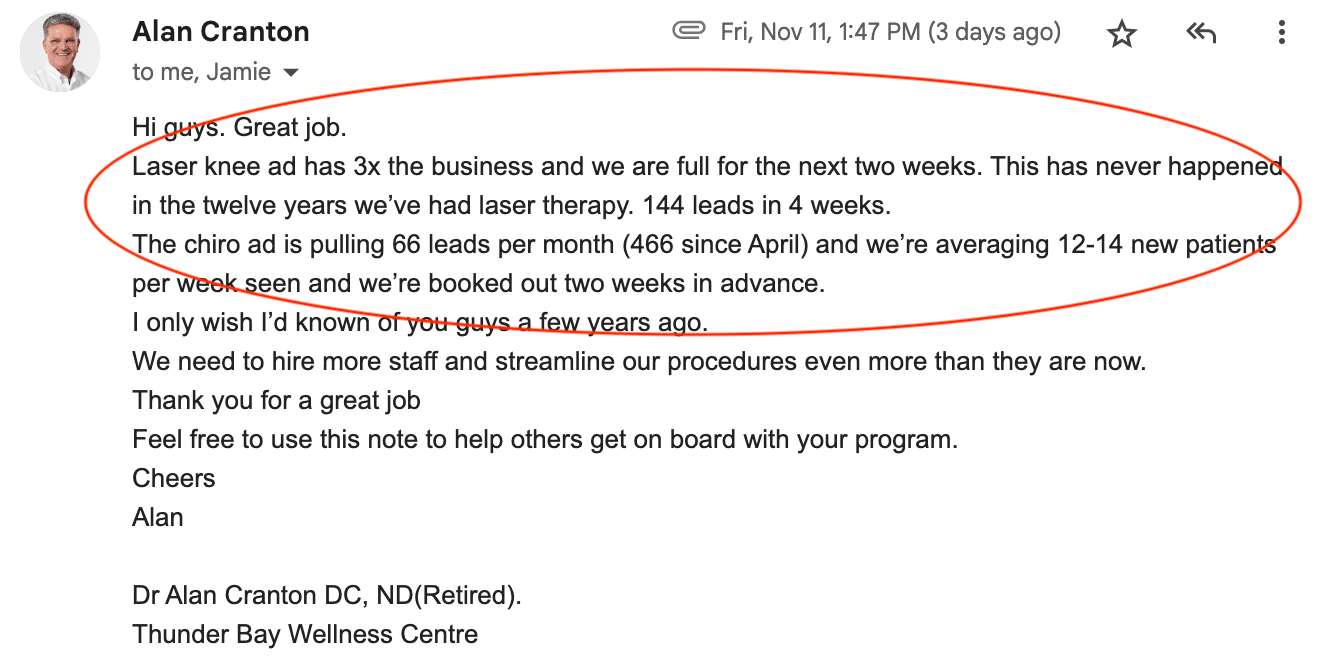

Alan Cranton

"Tripled in business, we just hit our best highest ever record of close to 100 clients in 12 years"

Josh Utchman

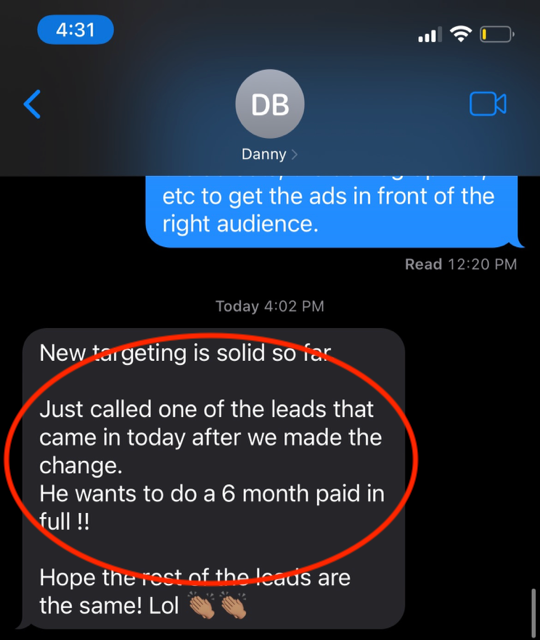

"Still getting quality leads 2 years later"

Morris Alexander

"$100k in Revenue in the First 2 Months"

Lorelei Zacharias

"I've seen more new clients in my first week with them than I had from Jan to March this year. My numbers have doubled on a weekly basis."

Alonso Martin MD

"Seen tremendous results in the practice. For anyone who is looking to scale their business and scale their practice to grab new leads and convert them, I highly recommend 7Figures"

Craig Cocek

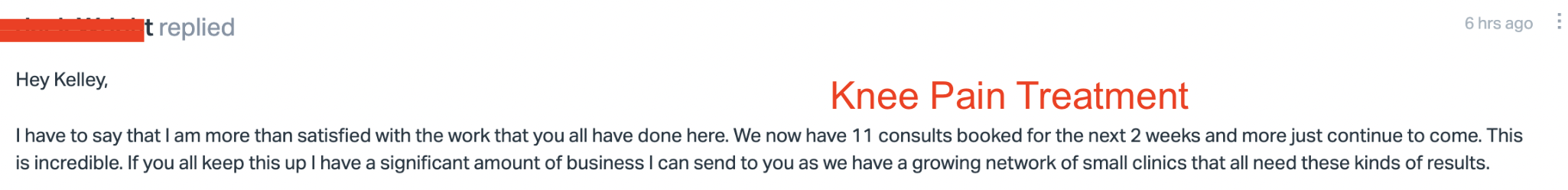

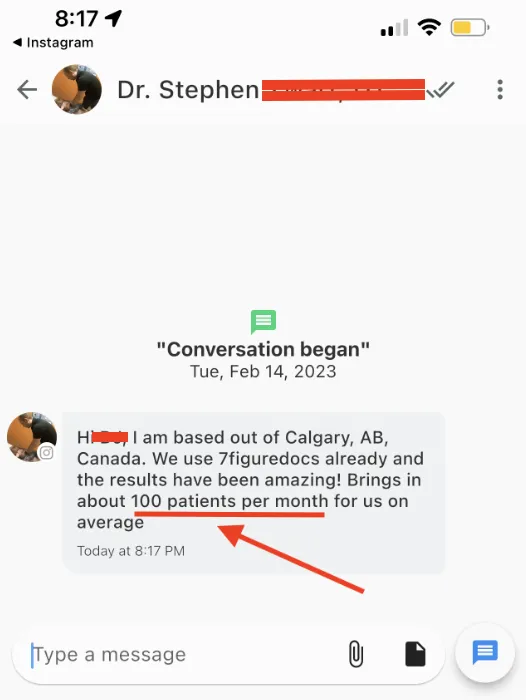

"We have been working with 7FD for 18 months - we see on average 20 to 30 new clients per month!"

Chris Stolzman

"6 Industries, 30 Businesses, 20 Agencies, nothing has worked as well as this"

Caroline

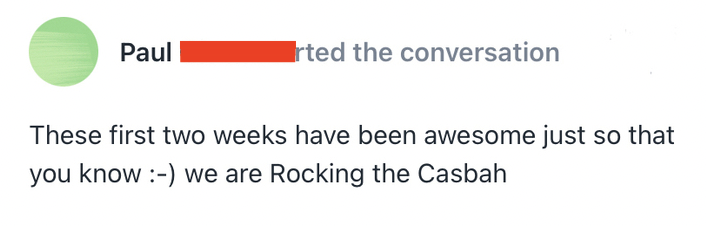

"Our results have been amazing"

Jean Gibson

"Over 3,000 Leads, 500 Pre Paid Appointments, and a 50% $2k Package Conversion Rate"

Rebecca Lee

"I was able to land my first premium sale of $1,300 after implementing Michael's strategies!"

Andy Wright

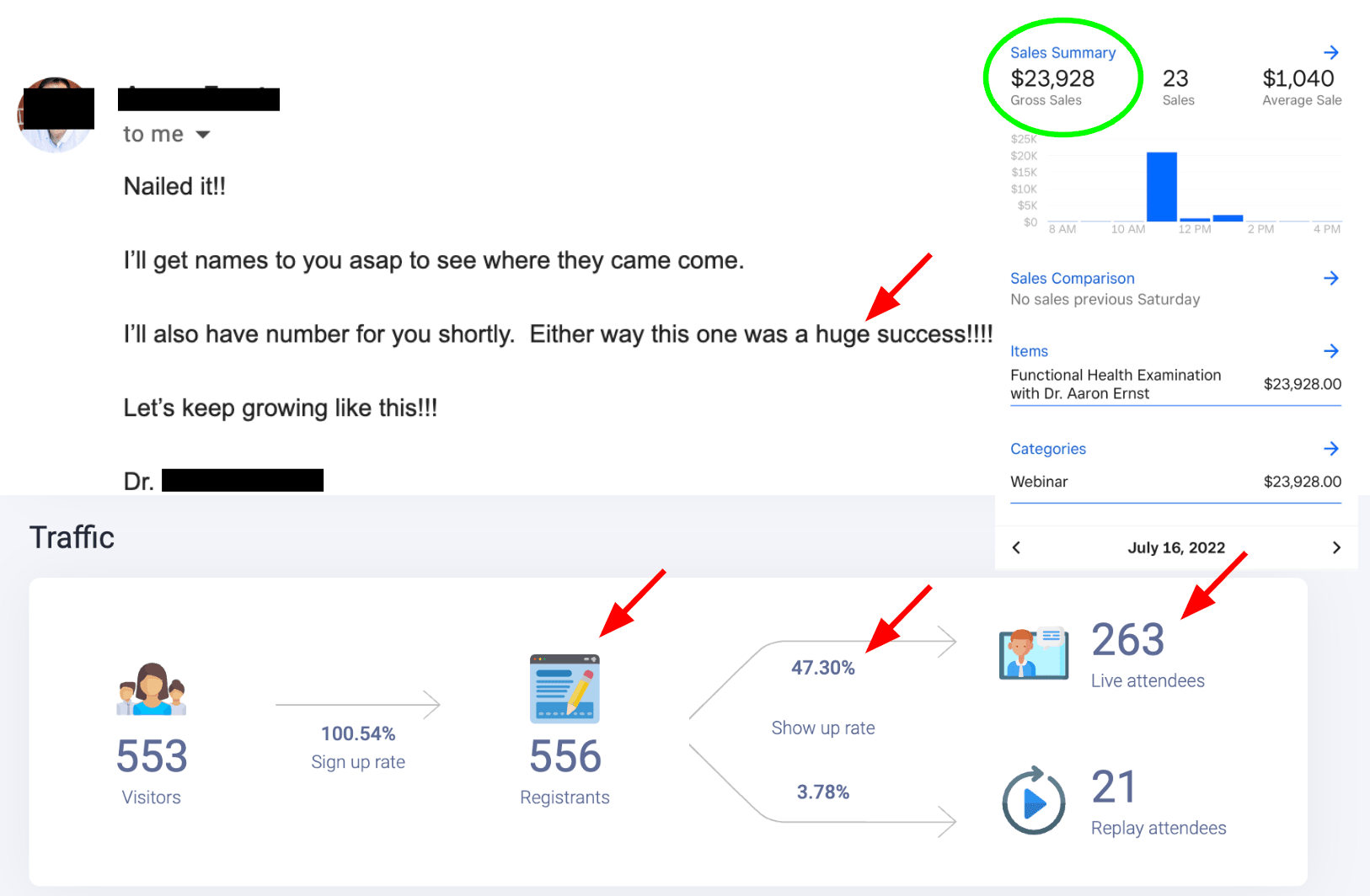

"We have used several companies in the past and 7Figures has by far been the best one. Good show up rates, sign up rates, & quality people in"

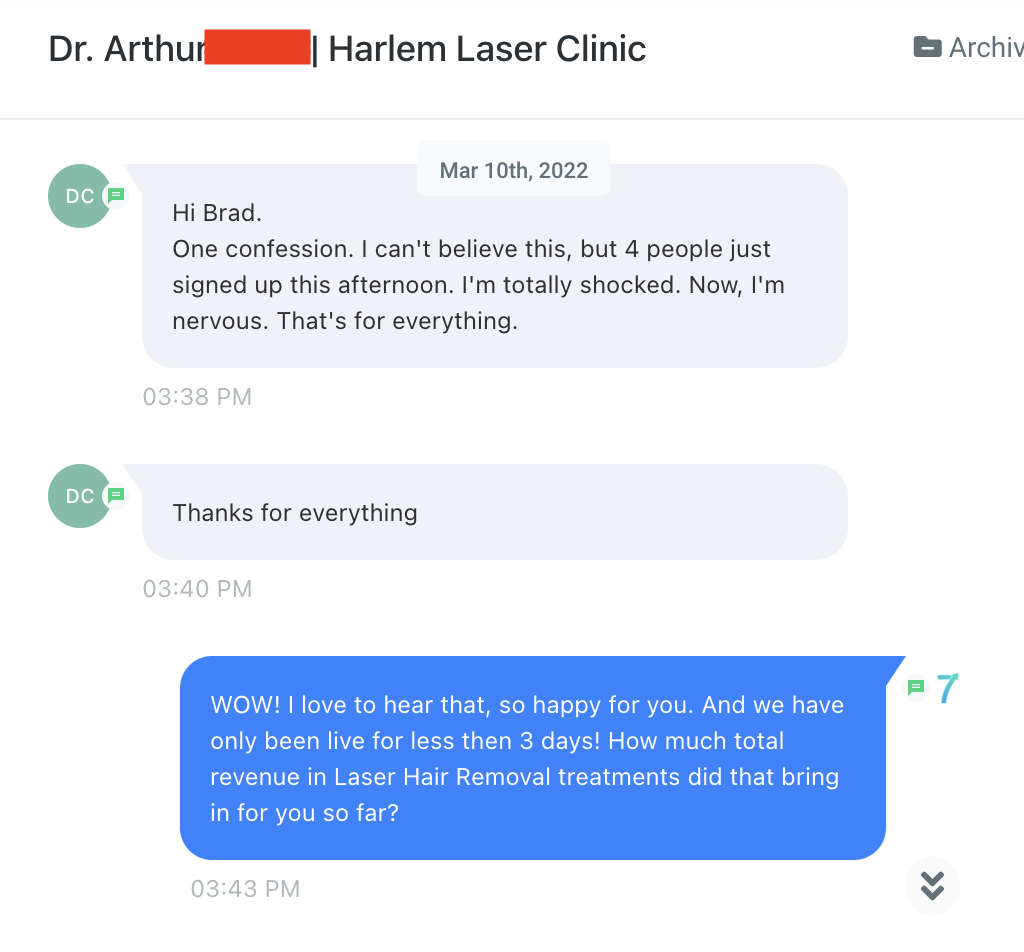

Arthur Dove

"Right after I signed up I started to receive new patients, this is amazing!"

Dr. Stephanie Louie

"I feel like my experience has been incredible. The customer service is impeccable"

*Terms and Conditions apply to any performance guarantee offered.

7FigureDental, a dedicated provider of professional legal marketing services, operates as a subsidiary under the broader umbrella of 7FigureDocs.

© 2023 7figuredocs.com - All rights reserved